A banking chatbot is your digital front desk, fielding questions and steering transactions around the clock. It slashes queue times and empowers customers to check balances, pay bills, or receive fraud warnings on their own. Chatbots boost operational efficiency and keep satisfaction levels high.

Understanding Chatbot For Banking

When you type a question into a bank’s chat window, an AI engine analyzes your intent in seconds. It plugs into core systems through APIs, pulling in real-time account details. From simple balance inquiries to basic fund transfers, these bots can handle it all.

Key Benefits:

- 24/7 Support that cuts queue times drastically

- Personalized Guidance powered by live account data

- Automated Alerts for payments, balance changes, and potential fraud

Many banks are investing heavily in conversational AI. The global chatbot market sits at $15.57 billion today and is on track to hit $46.64 billion by 2029, growing at a 24.53% CAGR. Learn more about these findings on Exploding Topics.

“Chatbots handle high-volume queries without breaks, boosting satisfaction.”

Roadmap For This Guide

In the following sections, you will uncover:

- Core components like NLP, dialog flows, and intent triggers

- Business impact metrics such as containment rate and cost per interaction

- Security measures, compliance checks, and data privacy best practices

- A step-by-step implementation roadmap and vendor selection tips

- Real-world examples highlighting success stories in small and growing firms

We start with the essentials and gradually move into advanced tactics. By the end, you’ll have both the strategic insights and the practical steps necessary to deploy a banking chatbot that delivers real ROI.

Banks worldwide are scaling up their chatbot programs to cut costs and forge deeper customer relationships. Conversational AI now sits at the heart of digital strategies across retail and corporate banking.

As you proceed, you’ll explore intent analysis, security frameworks, integration strategies, vendor criteria, and case studies packed with actionable templates. Get ready to embark on a confident, clear path toward chatbot success.

Understanding Banking Chatbot Concepts

A banking chatbot is like a branch teller who never clocks out. It greets users, listens attentively, and completes tasks no matter the hour. This simple image peels back the curtain on the tech behind those helpful chat windows.

Core Components

Behind every exchange, four systems team up:

- Intent Recognition figures out what a user wants.

- Dialog Flows keep the chat on track and remember context.

- Rule-Based vs. NLP Models decide whether to follow fixed patterns or learn from each interaction.

- Integration Layer hooks into core banking systems for live account, transaction, and alert data.

Think of intent recognition as a switchboard routing each question to the right module. “Transfer funds” fires up the payment logic; “account balance” calls the ledger. Dialog flows act like a script, storing details so if you say “Change that amount,” the bot knows exactly which number you mean.

Dialog Flow In Action

Imagine scheduling a bill payment over chat. The bot guides you step by step:

- “Who’s the payee?”

- “Which date should I use?”

- “How much would you like to send?”

Once it gathers that info, it repeats the details back for confirmation and executes the transfer.

| Feature | Rule-Based Bot | NLP-Driven Bot |

|---|---|---|

| Flexibility | Limited to set patterns | Adapts to varied phrasing |

| Training Required | Minimal | Extensive data needed |

| Error Handling | Rigid | Learns from interactions |

“A chatbot can handle up to 73% of simple requests without human intervention,” notes a recent industry insight.

Integration With Core Systems

Connecting a chatbot to your banking platform is a bit like wiring a snack machine to its inventory and payment gate. Everything must talk securely and instantly.

Key integration requirements:

- Strong authentication methods like OAuth

- Reliable uptime and monitoring tools

- Data mapping between chatbot fields and banking records

- Secure tokenization to protect sensitive information

Encrypted channels (think AES-256 or TLS) keep every request under lock and key. Context preservation also matters. When you mention “that amount,” the system reviews earlier steps to fill in the blanks. If a conversation drifts into complex territory—say, credit checks—the chatbot flags a human expert and forwards the entire history.

Routing Common Requests

-

Balance Inquiry

- Verifies identity, fetches data, and displays your balance.

-

Payment Execution

- Confirms payee details, enforces limits, and completes the transfer.

-

Fraud Monitoring

- Spots unusual patterns, asks for extra verification, and logs alerts.

-

Account Management

- Updates records, handles card replacements, or processes address changes.

By blending rule-based predictability with NLP adaptability, chatbots deliver a friendly, personalized interface. This exploration of core mechanics equips your team to design custom flows and integrate systems without missing a beat.

Developers can then log conversation metrics, spot patterns, and fine-tune each step for better performance.

Business Impact And Success Metrics For Chatbots

Every day, banks lean on chatbot for banking solutions to fuel growth and keep overhead in check. Tracking how these virtual helpers influence both revenue and expenses is crucial for making data-driven decisions.

Measurement works best when your KPIs tie back to business goals. In this section, you’ll find the metrics that matter and real-world snapshots illustrating their impact.

Key Performance Metrics

Start by keeping an eye on your Containment Rate—the share of customer questions your bot answers without any human handoff. If this rate sits at 75%, that means three out of four conversations never need an agent.

Next, calculate Cost Per Interaction, which often lands between $0.50 and $0.70, compared with $6 to $12 for a phone call.

- First Contact Resolution: Percentage of issues closed in the first chat.

- Customer Satisfaction Score (CSAT): Rating collected right after each conversation.

- Average Handling Time: Length of each session, helping you spot slow spots.

- Conversion Rate: How often users complete actions like a loan application.

- Abandonment Rate: Exits before task completion, highlighting friction points.

Common Use Cases And Benefits

Chatbots in banking tackle everything from account opening to fraud alerts. Below is a quick glance at the most popular uses and why they matter.

The table below matches some of the top chatbot use cases with their benefits and efficiency gains.

Use Cases Vs Benefits

| Use Case | Benefit | Efficiency Metric |

|---|---|---|

| Account Opening Automation | Cuts down manual form steps | 40% faster onboarding |

| Fraud Alert Notifications | Speeds up critical warnings | 85% quicker response |

| Personalized Financial Advice | Boosts product cross-sells | 30% more upsells |

| Payment Processing | Reduces human touchpoints | 50% drop in processing hours |

| Balance Inquiry | Delivers real-time updates | 70% self-service rate |

This snapshot shows how each chat feature drives efficiency or revenue gains across the board.

Real-World Examples

At a small credit union, a website and app bot lowered live-chat tickets by 15% and sped up response times by 30%.

A mid-sized bank rolled out a fraud-alert assistant and saw a response boost of 85%, helping cut losses and build trust.

At a global institution, a chatbot offering tailored advice improved first-contact resolution by 20% and lifted upsell revenue by 12%.

Industry-wide, digital assistants can trim costs by up to $0.70 per interaction, potentially saving banks $7.30 billion globally. Learn more about chatbot savings on Master of Code.

Measuring ROI Over Time

Begin by snapping a baseline—capture support volumes, handle times, and staffing costs before you go live.

- Collect Pre-Launch Data

- Document average handle times, ticket volumes, and salary expenses.

- Integrate Analytics Tools

- Centralize your KPIs in dashboards for a real-time view.

- Perform A/B Tests

- Pit different dialogue flows against each other to find the winner.

- Report Quarterly Outcomes

- Present ROI dashboards to stakeholders and recalibrate as needed.

This routine uncovers savings and revenue lifts, and charting the results helps keep the team focused on continuous improvement.

Best Practices You Need To Know

Align your chatbot’s objectives with clear business targets—whether that’s cutting support spend or ramping up engagement.

- Use strategic handoffs to agents for the trickiest queries.

- Alert your team if abandonment spikes or satisfaction dips.

- Refresh your knowledge base to keep answers accurate and compliant.

- Track CSAT alongside containment to ensure efficiency doesn’t undercut experience.

- Loop in stakeholders monthly to keep the roadmap on track.

Discipline in these areas turns your chatbot from a pilot project into a measurable business asset.

Benchmarking Chatbot Data

Comparing your results to peer benchmarks sets realistic goals and highlights where you stand.

- Regional banks often aim for 60% containment and a 4.2/5 CSAT in year one.

- Small credit unions typically hit over 50% containment with around 4/5 satisfaction.

- Mid-tier banks reach 65% containment and 4.5/5 CSAT in six months.

- Large banks push past 75% when they add AI-driven personalization.

- Adjust your targets as your bot tackles more complex, multi-step workflows.

Analyzing Conversation Quality

Quality metrics go beyond speed—focus on tone and true resolution.

- Flag phrases like “I don’t understand” to uncover missing intents.

- Measure sentiment per topic to pinpoint frustration hotspots.

- Track fallback rates to spot where the bot leans on human agents too often.

Regular transcript reviews help you tighten responses and boost the overall experience.

Continuous Improvement Cycles

Treat chatbot enhancement like agile sprints—small, frequent updates keep performance fresh.

- Plan Updates

- Use performance data and customer feedback to guide each sprint.

- Execute Tests

- Roll out tweaks to a subset of users and monitor key metrics.

- Review Outcomes

- Compare results to your baseline, then scale winning changes.

Visualizing Metrics For Stakeholders

Build dashboards that tell a story—trend lines, funnel charts, and heatmaps all have their place.

- Line graphs to show containment and CSAT over time.

- Funnel diagrams to illustrate loan-application flows.

- Heatmaps to highlight peak usage hours and drop-offs.

Sharing clear visuals in leadership meetings keeps everyone aligned on progress and priorities.

Future Outlook And Next Steps

Chatbots are only getting smarter. Plan today for the next wave of capabilities.

- Explore generative summaries and automated risk scoring.

- Pilot voice banking and multilingual chat support.

- Test proactive outreach with real-time account insights.

Lay out a three-year roadmap, tying each phase to projected ROI. Revisit your metrics regularly to respond to changing customer needs and compliance requirements.

A flexible strategy ensures chatbots remain a growth driver, not a legacy liability.

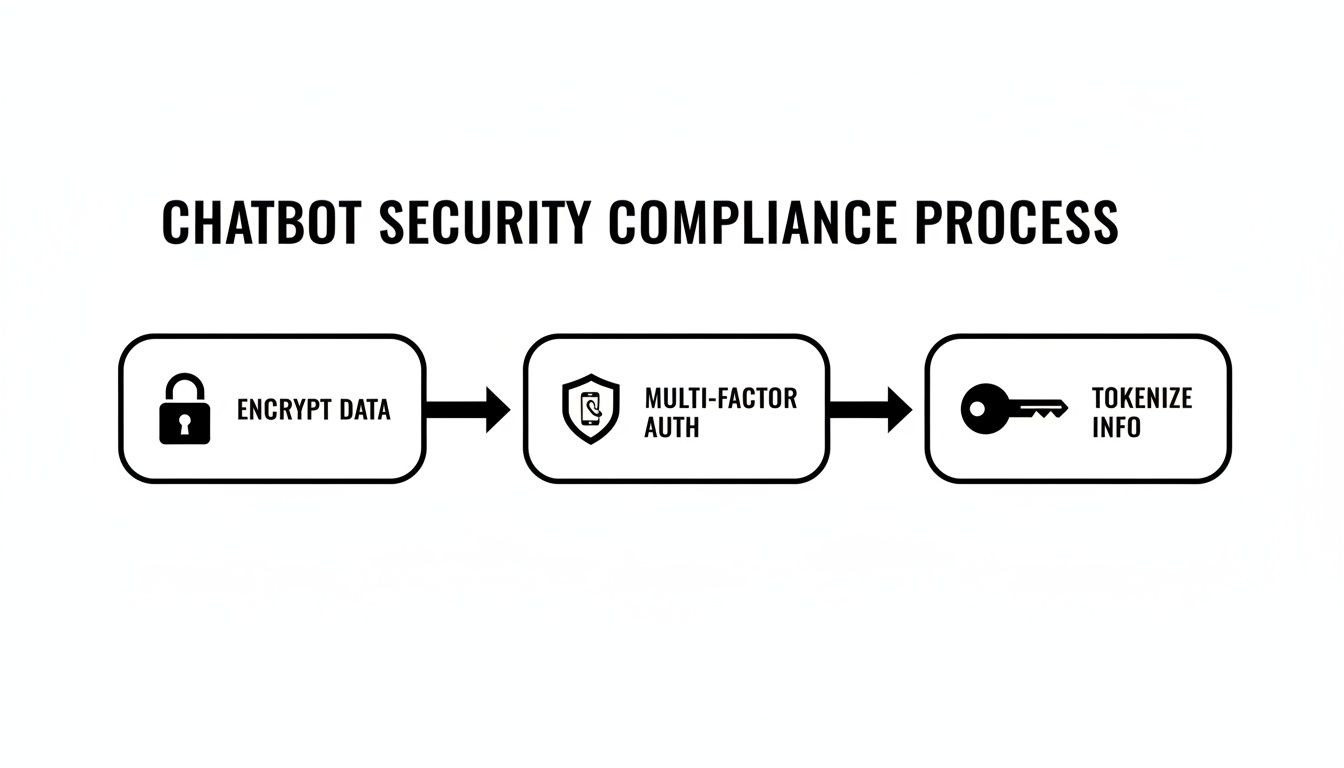

Chatbot Security Compliance And Data Privacy

Building a banking chatbot means your first priority is locking down security and meeting every compliance requirement. Users expect their data to be guarded as fiercely as vault contents. To strike the right balance, you need safeguards that don’t turn every interaction into a hurdle.

Encryption And Authentication

Think of encryption as wrapping data in an unbreakable steel box. For both transmission and storage, adopt AES-256 or TLS 1.2+. Tokenization swaps real payment details for safe placeholders, while multi-factor authentication (MFA) adds a second checkpoint—like a two-door corridor where each door has its own lock.

- Generate unique session tokens for every user interaction

- Sign payloads with HMAC or SHA-256

- Rotate encryption keys on a set schedule

- Send one-time codes via SMS or authenticator apps

Compliance Requirements

| Regulation | Focus | Impact |

|---|---|---|

| PCI DSS | Payment Data Protection | Requires tokenization and encryption |

| GDPR | Personal Data Privacy | Mandates consent and data access controls |

| CCPA | Consumer Data Rights | Enforces opt-out mechanisms and deletion requests |

| Local Laws | Residency & Storage | Dictates where data must be physically stored |

Data residency can mean hosting chat logs inside a specific country. For instance, European customers often need servers within the EEA. At the same time, continuous transaction monitoring and anomaly detection catch suspicious transfers as they happen.

“Real-time monitoring reduced fraudulent losses by 40% in small banks,” notes an industry report.

Best Practices For Privacy

Start every project with privacy baked in from day one. Map out how user input travels through your systems, then:

- Document all data touchpoints

- Run a privacy impact assessment ahead of launch

- Limit access—grant only what each role absolutely needs

- Schedule regular penetration tests and code reviews

- Keep a clear audit trail for every admin action

Be upfront with users about what you collect. Give them easy options to view, download, or delete their data. Regular training keeps your team in sync with evolving rules.

Audit Trails And KYC

Every chat session needs a secure, unalterable log. Embed KYC checks early—right when a new user sends their first message. Pseudonymize sensitive fields and trigger real-time alerts for high-risk activities.

- Track response latency, fallback triggers, and weird behavior counts

- Tie logs to unique user IDs, not personal details

- Enforce vendor SLAs that include data protection guarantees

Review contracts and certifications often. As regulations shift, your compliance strategy should move in step.

Chatbot Integration And Implementation Roadmap

Getting a banking chatbot off the ground means following a series of practical phases. At each step, you’ll track milestones, nail down key deliverables, and keep risks in check.

Before you start mapping tasks, revisit stakeholder objectives and agree on what success looks like. Align around KPIs such as Containment Rate and customer satisfaction so every milestone delivers real value.

That snapshot lays out phases, timelines, and ownership. It’s your quick reference for adapting timelines to your institution’s scale and resources.

Planning And Stakeholder Alignment

Kick things off by convening your core team—product, IT, compliance and operations all need a seat at the table. Set up a steering committee with clear decision rights to speed approvals. Define a target like a 20% drop in support tickets so everyone knows the goal.

- Identify sponsors and assign roles.

- Establish communication channels and meeting cadence.

- Draft a project charter covering scope, budget and success criteria.

Vendor Evaluation Criteria

Picking the right chatbot platform can shave weeks off your rollout. Look for mature AI features, robust security certifications and a support model that fits your hours. You’ll also want to weigh on-premises versus cloud options based on data residency rules.

- Evaluate natural language understanding accuracy.

- Check compliance standards (e.g., ISO 27001, SOC 2).

- Compare support SLAs and escalation paths.

- Decide deployment model: cloud, hybrid or on-premise.

“Aligning vendor choice can cut integration time by 30%,” an industry veteran points out.

Data Mapping And API Integration

Here, you’ll link each banking service—balances, transfers, fraud alerts—to the chatbot’s intent framework. Secure data pipelines using OAuth and TLS, and layer in tokenization for payments plus MFA on high-risk requests.

- Catalog necessary APIs and data models.

- Create a field-to-intent mapping document.

- Run sandbox tests to validate end-to-end flows.

Security And Compliance Considerations

Security isn’t optional—so bake it into every phase. Make encryption, multi-factor authentication and tokenization your baseline. Regularly audit data handling against PCI DSS, GDPR or local regulations.

- Encrypt data both at rest and in transit.

- Enforce MFA on sensitive operations.

- Tokenize payment and personal data fields.

- Schedule compliance reviews at major milestones.

Pilot Testing And Feedback Loops

A small-scale pilot surfaces real-world gaps before full launch. Recruit a mix of power users and newcomers to test flows, then prioritize fixes based on severity.

- Monitor fallback rates and sentiment scores.

- Collect session logs for audit and tuning.

- Hold weekly feedback meetings with stakeholders.

Below is a concise view of each stage, its core tasks and expected outputs.

Implementation Roadmap Stages

| Phase | Key Tasks | Deliverables | Timeline |

|---|---|---|---|

| Planning | Stakeholder alignment, charter | Project charter | 2 weeks |

| Integration | API mapping, security setup | Integration test report | 3 weeks |

| Pilot | User trials, feedback gathering | Issue backlog and analytics | 4 weeks |

| Rollout | Training, launch checklist | Live chatbot and training docs | 2 weeks |

Use this table as your project compass—adjust timing and scope to match your team’s bandwidth.

Full Scale Rollout And Training

Train customer-service staff on when to hand off to a human and how to handle escalations. Update internal playbooks to reflect chatbot scripts and new processes. Launch a user communication campaign to spotlight 24/7 chat support.

- Conduct role-play sessions with support agents.

- Finalize escalation workflows and SLAs.

- Send out email or in-app alerts about the new service.

Post Launch Optimization

Once live, set up a real-time dashboard tracking conversation success, sentiment trends and error rates. Keep refining dialogues based on top fallback scenarios and user feedback.

- Refine flows around high-volume intents.

- Schedule monthly compliance and legal reviews.

- Roll out incremental feature updates in phases.

- Embed a quick survey at conversation end to gauge satisfaction.

Document each iteration carefully. Over time, these continuous improvements turn your chatbot into a powerful engine for customer engagement and operational efficiency.

How To Choose The Right Chatbot Vendor

Picking the right chatbot partner can make or break your banking project. Before you commit, walk through a structured evaluation to compare core AI features, integration needs, security standards and support options.

Essential Vendor Criteria

Every vendor touts strong capabilities, but you’ll want to zero in on these fundamentals:

- Natural Language Understanding: Accuracy in interpreting queries and keeping context over multiple messages.

- Integration Flexibility: Smooth connections to core banking systems via secure APIs and SDKs.

- Security Certifications: Proof points like ISO 27001, SOC 2 and PCI DSS show a vendor takes data protection seriously.

- Support Model: Defined SLAs, clear escalation paths and guaranteed response times keep your service running without a hitch.

You’ll also face a key deployment choice: on-premises or cloud. This decision shapes everything from control over data residency to scaling plans.

| Deployment Option | Data Residency | Maintenance Overhead | Scalability |

|---|---|---|---|

| On-Premises | Full control within your network | High hardware and staffing costs | Limited by local resources |

| Cloud | Hosted in provider’s infrastructure | Managed by vendor with automatic updates | Elastic, pay-as-you-go expansion |

Calculating total cost of ownership means more than a license fee. Ask for detailed quotes and watch for hidden charges—training sessions, upgrade costs or overage fees can add up quickly.

Demo Questions To Ask

- What data sources feed your AI model, and how often is it retrained?

- How do you handle data privacy, and can you share recent compliance reports?

- Can we test real integration workflows in a sandbox environment?

- What are your guaranteed support response times and escalation procedures?

- What’s on your product roadmap, and can we request custom features?

Score each vendor against your must-have and nice-to-have criteria to narrow down contenders.

In one recent survey, 92% of North American banks reported using AI chatbots, signaling that vendor choice has become critical as financial institutions invest heavily in these solutions. Learn more about these findings on Fullview

Key Considerations

- Review vendor case studies and track records in the banking sector.

- Confirm they undergo regular third-party audits and comply with evolving regulations.

- Look for conversational design options that match your brand’s tone and voice.

- Ensure your contract clearly states who owns the data and how it’s managed.

Review service level agreements closely to verify uptime guarantees. You’ll also want access to live performance dashboards or sandbox metrics for ongoing monitoring.

Vendor Selection Example

A regional credit union picked a vendor with SOC 2 certification and sandbox APIs. As a result, they cut integration time by 25%.

They scored prospects on intent accuracy, data residency and support SLAs, turning a complex choice into a data-driven decision.

Following this checklist helps small and growing banks select a chatbot that lifts customer service, stays compliant and scales with your business needs.

More partnering with BizSage at https://bizsage.io.

Chatbot For Banking FAQ

Implementing a chatbot in a banking environment often brings up practical questions.

This FAQ dives into ROI, security measures, integration timelines and tips for driving user adoption.

What Kind Of ROI Should You Expect?

In real-world cases, banks achieve a 60–80% containment rate, slashing a live-chat interaction cost from about $8 to just $0.70. Over a year, that can mean more than $200,000+ in savings for a small institution. Monitoring support ticket volumes and average handling times before and after launch delivers clear ROI insights.

How Secure Is A Banking Chatbot?

When you follow PCI DSS and GDPR standards, encrypt data with AES-256, and enforce multi-factor authentication, you meet the toughest security benchmarks. Regular penetration tests and simulated breach drills help you spot vulnerabilities early.

What Integration Timeline Should You Plan?

A typical small-bank rollout looks like this:

- Weeks 1–4: Map core APIs and complete sandbox testing

- Weeks 5–6: Run pilot tests and capture edge-case feedback

Phasing the project this way minimizes surprises and keeps risk under control.

How Do You Drive Adoption?

A nudge goes a long way. Combining email reminders with in-app prompts can boost engagement by 40%.

Security Best Practices

Locking down data streams and user sessions is non-negotiable.

- AES-256 encryption for data at rest and TLS 1.2+ in transit

- Session token rotation with HMAC signature checks

- Privacy impact assessments and scheduled penetration tests

Integration Timeline And Adoption Tips

From planning to pilot, aim for a 4–8 Week rollout. Key milestones include API mapping, sandbox tests, and team training. Align stakeholders early to shave weeks off your schedule and lift adoption by 30%.

Consider these steps:

- Launch a small-scale pilot group

- Gather on-the-ground feedback and refine your conversation flows

- Train support teams on seamless handoff protocols

We saw a 45% jump in user adoption when one mid-tier bank combined email alerts with an in-app guided tour.

Ready to streamline customer support? Give BizSage a try today.